Home > Off the Charts > Unlocking Value through Virtualized Healthcare: Which Countries are Ready?

Unlocking Value through Virtualized Healthcare: Which Countries are Ready?

Summary

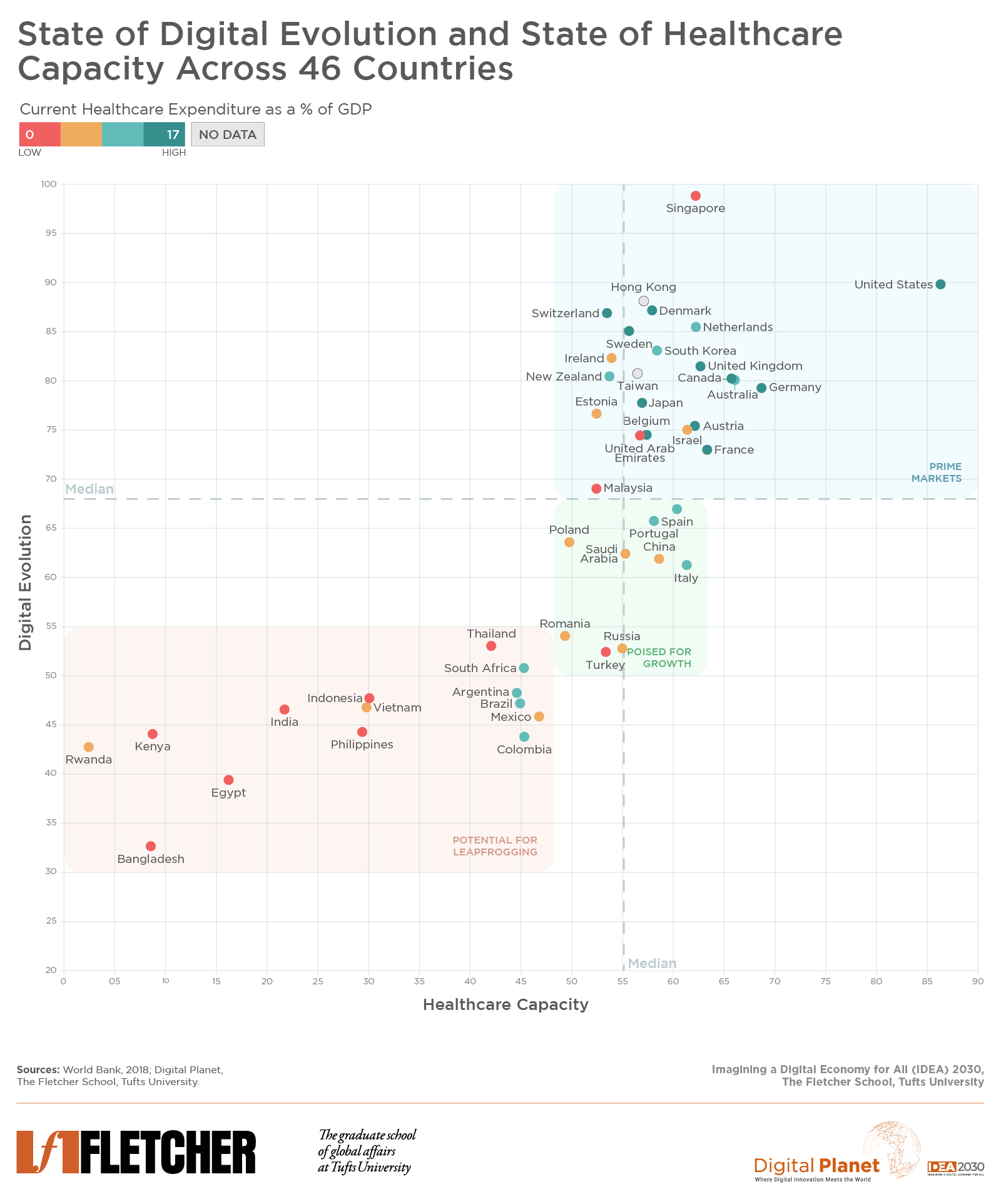

The state of digitization of healthcare delivery globally is quite uneven, spotted with patches of excellence and falling well short in others. Digitally administered medicine is yet to reach corners of the world where its need is the greatest. Our study spanning 46 countries, where we overlaid our measures of digitalization and healthcare capacity, reveals sweet spots for virtualized healthcare and how countries lagging in critical healthcare infrastructure can leapfrog by deploying digital mechanisms to provide quality healthcare to their masses.

The health care industry globally has a reputation for being slow to digitization compared to other consumer industries such as travel, retail, and financial services. While these industries are not all regulated alike and the healthcare industry is, for good reasons, more heavily regulated and is expected – much more than others – to thread the needle between “first, do no harm” and “moving fast” without breaking things, such perceptions of low and slow adoption of digital technologies have some basis in fact. The consumer-facing and primary care aspects of the industry have certainly been slower to digitization; case in point: the reams of paperwork filled out by patients at clinics on a daily basis in most parts of the world and the ubiquity of fax machines across the American medical sector to this date, three decades after most other industries jettisoned them.

And yet, technological innovations and innovation enabling policies, have been permeating various facets of healthcare delivery around the world. These innovations and policies are widely distributed across the care delivery system writ large – sometimes tangible, other times barely visible – such as regulations governing cross-border flows of healthcare data, digitally intermediated real-time critical care across time zones, and the electronic identity enabled system-wide digitization of healthcare delivery. Consider advanced economies such as Estonia where 99% of all health data and prescriptions are digitized as is the entire billing process, all of which runs on the rails of a digital identity-based nationwide electronic health record network, and New Zealand, where the government instituted a citizen privacy preserving “we will ask only once” policy approach to digital public services such as verifiable claims including all aspects of healthcare. Innovations, albeit of a frugal variety, have taken root in the global south despite (or perhaps because of) capacity constraints in digital connectivity and healthcare infrastructure. Consider Ziqitza Health Care Limited, a social enterprise that provides ambulance services to all segments of society in several parts of India using basic call center infrastructure.

Within the care delivery value chain, there are spots of digital distinction in secondary and tertiary care. Consider the recent pioneering partnership between Emory Healthcare, Royal Perth Hospital in Australia, and Philips, a technology company, which is pushing the frontiers of digital globalization of critical care by facilitating Emory ICU physicians and nurses to deliver real-time care “from the other side of the Earth by working in daylight hours in Australia to cover nighttime hours in Atlanta.” In recent years, digital health-focused startups have been active in many parts of the world across several functions of care delivery: from administrative automation, clinical intelligence, and pharma supply chains to virtual care delivery, drug discovery, and screening and diagnostics.

All innovations considered, the state of digitization of healthcare delivery globally is quite uneven — spotted with patches of excellence and falling well short in others. Digitally administered medicine is yet to reach corners of the world where its need is the greatest.

The pandemic has both exposed this state of unevenness around the world and accelerated the embrace of digital technologies by healthcare providers and patients alike especially in the delivery of primary care. Telemedicine, online pharmacies, online therapy and wellness, and the use of wearable monitoring devices have been on the rise through 2020. Consumers and providers are warming up to the value potential of telemedicine and virtualized medicine. In a recent survey of consumers in the United States, convenience, speed, and quality care were rated among the top reasons for using telehealth services. A study by McKinsey & Company, a consultancy, noted that a sustained acceleration of the pandemic-induced trends of consumer and provider adoption of telehealth and the extension of telemedicine beyond virtual urgent care into virtualizing other aspects of healthcare delivery in the United States could unlock value to the tune of “approximately US$250 billion or ~20% of all Medicare, Medicaid, and commercial outpatient, office, and home health spend.”

With a view to providing guidance to policymakers, decisionmakers, technologists and healthcare administrators, we posed the question, which countries are most ready to unlock value though delivery of virtualized healthcare at scale?

Identifying the Sweet Spots for Virtualized Healthcare Across 46 Countries

To understand countries’ digital health capacities and their potential to unlock value through virtualized care delivery – at scale and where it is needed the most – we overlaid our measure of the current “state of digital evolution” from our Digital Intelligence Index, which captures the level of digitalization in a country, against our measure of “healthcare capacity”, which encompasses the robustness of the soft and hard healthcare infrastructure of a country, for 46 economies from around the world. Pairing the two measures provides a mapping of potential virtualized healthcare sweet spots.

The state of digital evolution captures the robustness of the digital ecosystem, including factors like the quality of and access to, electricity, broadband, and digital hardware; utilization of digital payments and equity gaps between poor and rich populations; digital innovation and know-how; and institutional frameworks that govern online environments.

The state of healthcare capacity measures the prevalence and maturity of regulations governing healthcare; patient privacy and electronic health records systems; doctors per capita; medical insurance coverage; and private sector innovations in digital health.

Findings

Countries with a high state of digital evolution and healthcare capacity are primed for unlocking value for consumers, providers, and other actors in the care delivery value chain through virtualized healthcare. Beyond delivering quick quality care at low cost to consumers within their markets, these countries are also best positioned to extend care and expertise – in the form of “virtualized doctors without borders” – to countries that are lacking in healthcare capacity. Among these “prime markets,” countries that also rank highly on our Digital Trust scorecard on trust building environment measures – of accountability, privacy, and security – such as Denmark, Switzerland, Netherlands, Sweden, Singapore, New Zealand, and the U.K. are best positioned to bring forth consumer privacy preserving innovations to advance virtualization of care.

A second group of countries with near median levels of digital evolution and healthcare capacity such as Turkey, Romania, Saudi Arabia, Russia, and China are poised to unlock value through virtualization provided they improve their digital trust environments, on which they perform rather poorly, in addition to making improvements on their overall state of digital evolution. The lack of user trust is a barrier in these markets for scaling digital medicine.

Lastly, countries in the bottom left are challenged both on their healthcare capacities – which are being sorely tested during the pandemic especially in Brazil, South Africa, Philippines, and India – and on their state of digital evolution. These are also markets where large gaps in healthcare access persist and the need for digitally administered medical services is the greatest. They have tremendous potential for leapfrogging and for deploying digital mechanisms to overcome critical health infrastructure gaps and provide quality healthcare to their masses. Policymakers and market actors in these countries would do well to address the digital inclusion challenges, improve the state of digitalization, and invest in building digital identity and payment rails. Their path to unlocking the potential of virtualized care is through investing in digitalization first. This sequencing is critical to success.

Unlocking Value in Virtualization

While the magnitude of value will vary by country, the benefits in terms of both expanding the scale and scope of virtualized care and bringing access to affordable care for billions of people around the world that need it the most, do not. For consumers this value can be expected in terms of convenience, time, quality, affordability. Providers and insurers stand to see cost savings, efficiencies, and capacity optimization.

Irrespective of the type of healthcare system followed by each country, there is value to be unlocked. For countries to benefit from virtualized care they need, among other things, a strong state of digitalization – consumers with high digital dexterity, abundant access to broadband and digital devices, analog and digital foundations, etc. – and robust healthcare capacity – medical talent, care infrastructure, digitized health record systems, etc. – bolstered by enabling institutional and regulatory environments that uphold consumer privacy, trust, and security, and a fecund innovation ecosystem.

Research Methodology

Digital Evolution

Digital Evolution is a composite measure of the current state of digitalization in a given economy, pulled from Digital Planet’s Digital Intelligence Index. It is a data-driven holistic evaluation of the progress of the digital economy, combining 160 different indicators into four key drivers: Supply Conditions, Demand Conditions, Institutional Environment, and Innovation and Change.

It is structured at four levels: indicators, clusters, components, and drivers. Indicators are standardized data points that answer a specific question. Indicators are aggregated up into clusters, which illuminate 35 aspects of digitalization, which are then rolled into 13 higher-order components, which ultimately feed into the four drivers. After indicators have been standardized and aggregated up into clusters, components, drivers, and ultimately final scores, final scores are rescaled to fit a 0 to 100 range.

Healthcare Capacity

Healthcare Capacity is a composite measure of countries’ health conditions, comprised of 15 indicators across the same four key drivers of Supply Conditions, Demand Conditions, Institutional Environment, and Innovation and Change. It is similarly structured at four levels: indicators, clusters, components, and drivers. After indicators have been standardized and aggregated up into clusters, components, drivers, and ultimately final scores, final scores are rescaled to fit a 0 to 100 range.

Current Health Expenditure as a Percentage of GDP

Data on the current health expenditure as a percentage of GDP in 2018 is pulled from the World Bank.

All data and sources are available here.

Graduate Student Analysts Patrick Béliard, Malavika Krishnan and Devyani Singh worked on this analysis under the guidance of Ravi Shankar Chaturvedi and Christina Filipovic at Digital Planet, The Fletcher School, Tufts University.

This research is a part of the IDEA 2030 initiative, made possible by the generous support from the Mastercard Center for Inclusive Growth