Home > Off the Charts > Uneven State of the Union

Color of Disparity

Addressing extant racial gaps in digital and economic capital key to ensuring an inclusive recovery

Pre-existing racial disparities in unemployment, digital access, and financial resilience have been exacerbated in COVID-19’s wake. Black communities have been disproportionately impacted––in mortality, morbidity, unemployment, and financial losses. As governments and businesses prepare to navigate the economic and public health repercussions of the pandemic, it is crucial to account for these extant inequalities to ensure inclusive recovery.

Key Observations and Insights

In our recent webinar on the Uneven State of the Union, we discussed how the COVID-19 pandemic has laid bare disparities across the 50 states and the District of Columbia. The racial digital divide – that is, the disparity in access to digital devices and broadband connectivity across races and ethnicities – critically impacts people’s ability to work from home and participate in the economy. With the exception of Alaska, Hawaii, and New Hampshire, Black households have disproportionately lower access to internet and computers compared to other races and the state average.

The Correlation Between Racial Digital Divide and Racial Unemployment Divide

In this note, we take an in-depth look at the racial divide in pandemic unemployment, as well as financial resilience amongst those with low or no income.

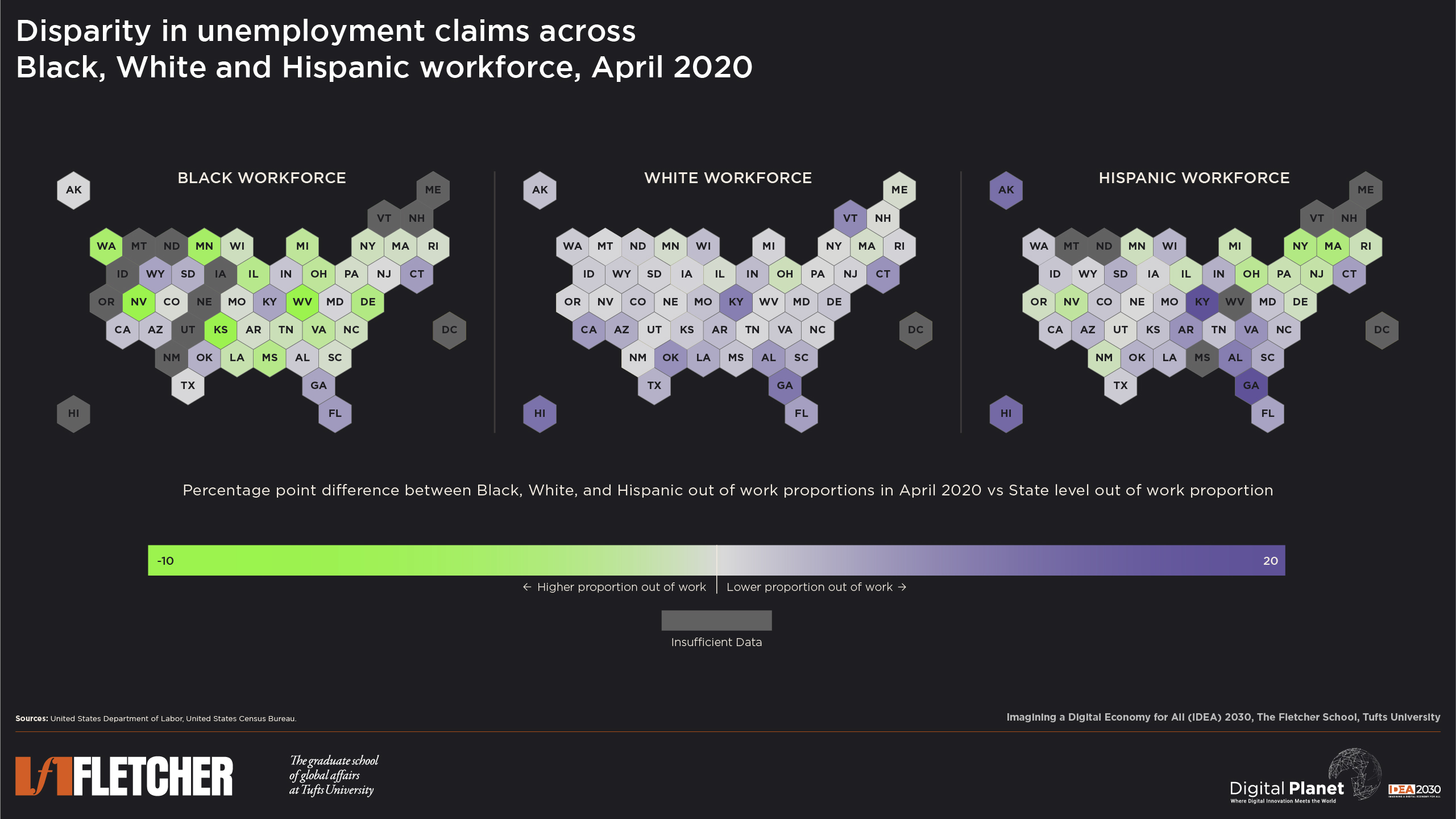

Of the 38 states where complete racial breakdown on unemployment insurance claims were available, an overwhelming majority had a higher Black out of work population, relative to the state average, or even White or Hispanic out of work populations. Thus, the spate of job losses in recent months has fallen much harder on Black communities. Importantly, this racial unemployment divide is highly correlated with the racial digital divide. Historically, Black households have had lower access to the building blocks that enable entry into the digital economy, and as such, have been grossly underrepresented in higher-pay, technology enabled occupations, and over-represented in low tech, frontline, and essential services. This digital divide implies not only that fewer Black workers were able to partake of flexible work environments (thus resulting in higher employment losses), but that they also had thinner economic cushions to rely on in times of need, as well as lower access to digital public services (like filing for unemployment insurance online or accessing relief checks).

Highest Burden on the Least Resilient

Additionally, the persistent and systemic racial economic and social resilience divide worsens matters. According to the Prosperity Now Scorecard, in 2018, 9.8% of White households had incomes below the federal poverty threshold, compared to 22.7% of Black households and 20.9% of Hispanic or Latino households. With more than a fifth of Black households earning barely enough to sustain themselves, they are notably the first ones to be impacted most by a sudden loss of income. Over the last decade, this economic divide has only widened, pushing several Black households deep into financial vulnerability.

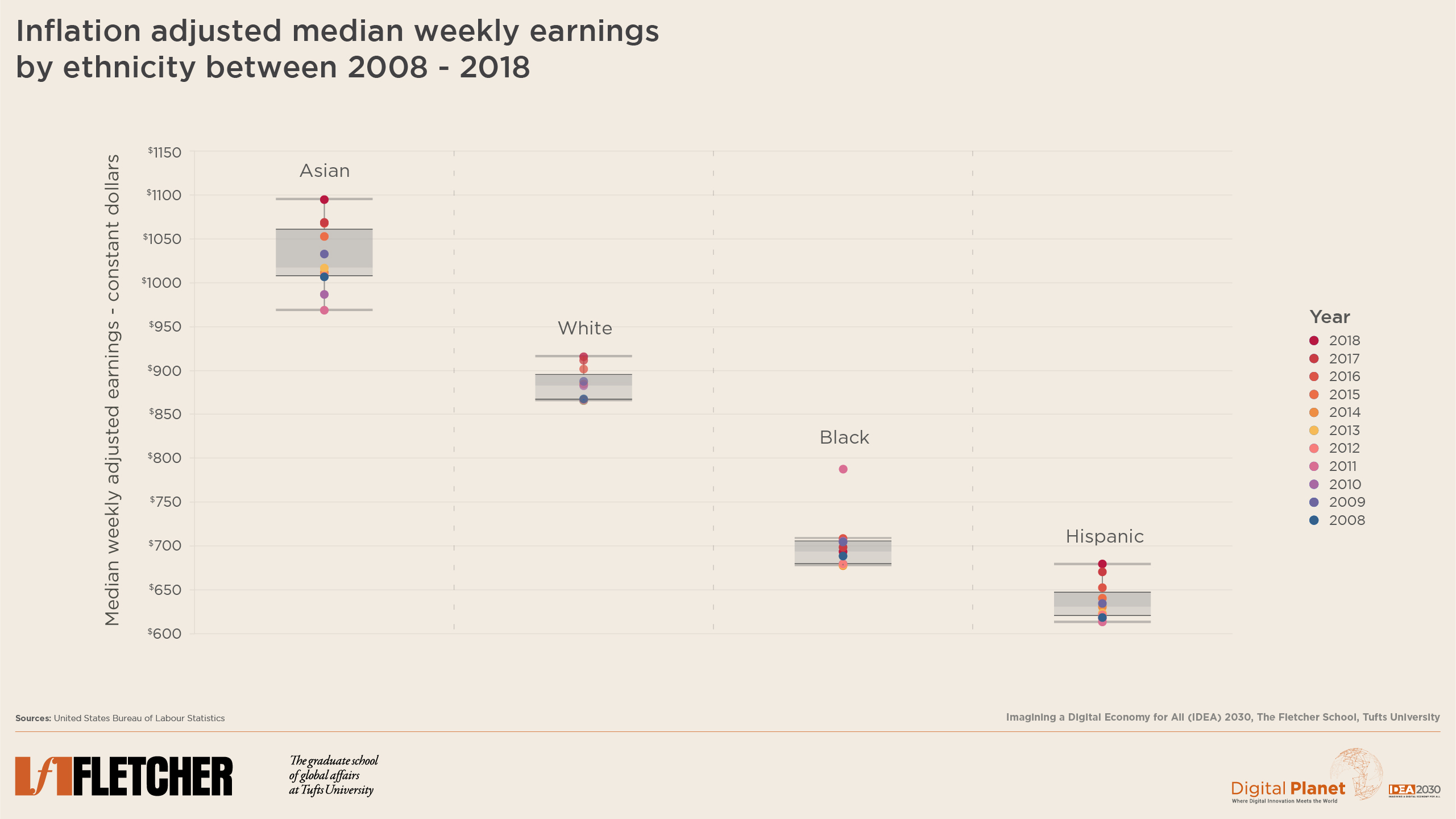

Data from the Bureau of Labor Statistics demonstrates that inflation adjusted median weekly wages for Black workers grew at a compounded annual growth rate of merely 0.07% over the last decade, compared to 0.54% for White Non-Hispanics and 0.84% for Asians. In 2008, the median weekly earnings for Blacks was $179 lower than their White counterparts, and this gap increased to $222 in 2018.

Not only are Black households more economically vulnerable to the pandemic’s effects, they also suffer in terms of their access to healthcare services. Of the 566 U.S. counties with the highest risk of health and economic disruption from the coronavirus crisis, 244 are home to almost 40% of all Black Americans.

Systemic Financial Exclusion––Perpetuating and Perpetuated by the Growing Digital and Unemployment Divide

On top of Black households’ low earning capacity and employment in less digitally-enabled jobs, they also have limited access to financial instruments to save and accrue wealth.

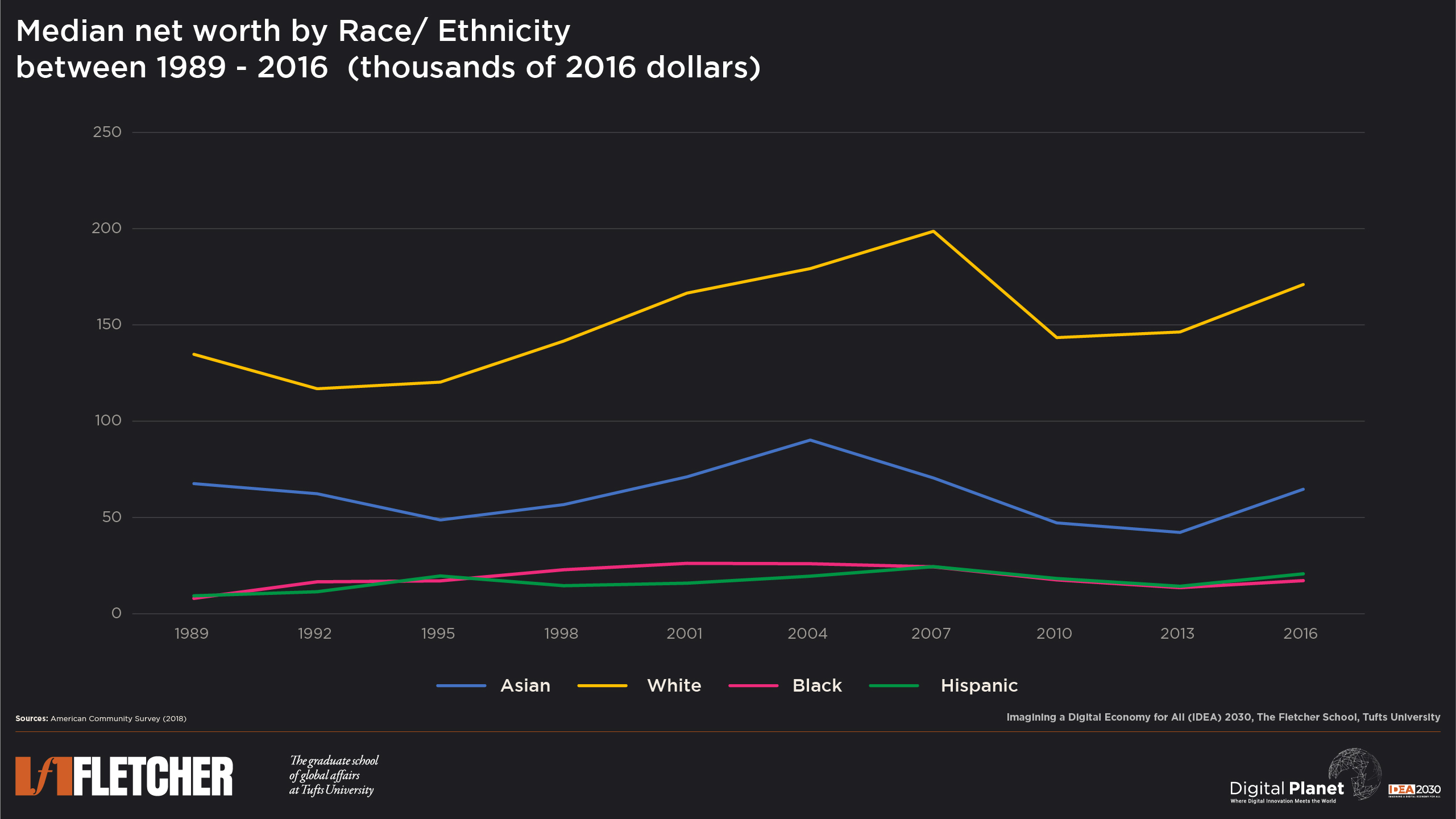

According to the Federal Reserve’s Survey of Consumer Finances, the median net worth of Black households (in 2016 dollars) grew from $8,000 in 1989 to a little over $17,000 in 2016. In contrast, in 2016, the median net worth of White households was more than 10 times higher at $171,000. The racial wealth gap between Black and White households widened from $126,000 in 1989 (in 2016 dollars) to $154,000 in 2016. This growing racial wealth gap in part stems from the continued lack of access to, and high cost of, financial services for Black individuals, combined with slim increases in real incomes. In Black neighborhoods, almost 60% of each paycheck needs to be deposited to avoid fees or account closures, compared to 28% for White neighborhoods. Less than 50% of Black families are able to save money, in contrast with an average of 60% of White families––a fact that has remained largely consistent over the last two decades. Moreover, non-financial assets such as home ownership play a key role in contributing to gaps in wealth accumulation. While median homeownership rates across most urban areas hover around 70%, in majority-Black neighborhoods, this frequently falls below 50%.

In the past few months, Black Americans have suffered disproportionately, from higher mortality to unemployment rates. As state governments grapple with the twin challenges of disruptions to the economic health and public health, and as the private sector gears up to adopt to flexible working environments in response to the pandemic, it is paramount to address these persistent systemic racial gaps. Economic resilience plays a key role in how communities navigate unprecedented situations and widening inequalities – if left unaddressed – only exacerbate intergenerational economic precariousness.

Research Methodology

Out of work population

Out of work population is defined as the ratio of unemployment claims to civilian workforce employed, by race. State-level race data on unemployment insurance claims as of April 2020 is from the United States Department of Labor, while civilian employed workforce by race as of 2019 is from the U.S. Bureau of Labor Statistics, Current Population Survey. Out of the 50 states, only 39 had data on unemployment insurance claims by Black workforce and 43 for Hispanic workforce. There was no race data on unemployment insurance claims for the District of Columbia.

Median weekly wages

Data on inflation adjusted median weekly wage earnings of full-time wage and salary workers above the age of 16 and across all industries and education levels, by race and ethnicity, was obtained from the Current Population Survey, as published by the U.S. Bureau of Labour Statistics.

Median net worth

Net worth is defined as the net value of each family’s liquid and illiquid assets and debts.

Data on median net worth across races from 1989 to 2016 was obtained from the Federal Reserve’s Survey of Consumer Finances.

All data and sources are available here.

Former Digital Planet Graduate Analysts Malavika Krishnan, Madhuri Mukherjee, and Devyani Singh worked on this analysis under the guidance of Bhaskar Chakravorti, Ravi Shankar Chaturvedi, Christina Filipovic, and Joy Zhang at Digital Planet, The Fletcher School, Tufts University.

This research is a part of the IDEA 2030 initiative, made possible by the generous support from the Mastercard Center for Inclusive Growth